HELP LINE +91 9883818627

HELP LINE +91 9883818627

Mutual Fund distribution is a great business to be in. However, among thousands of IFAs who join this business every year, few make it big but many IFAs either just survive or exit very early. This is because they do not get proper guidance and road-map of how to go about this business. This book will act as a guide to such IFAs. Written by a successful IFA himself, this book talks about the practical aspect of this business. Available in Hindi also at Amazon & Flipkart.

To become a successful investment advisor, sales is not sufficient. You must have excellent systems and processes. Also, there is an easier way to acquire more clients and grow faster. The Supernova Advisor will give excellent insights on how to become more effective. Strongly recommend to every MFD.

It contains powerful lessons and proven strategies from successful advisors. It features select few advisors in the US who reached a level of 1 million dollars or more in earning every year. How did they do it? What is their mindset? What are the things they focus on? How do they market themselves and their products? How they manage their time? All this and much more is covered in this book. I would strongly recommend this book to each and every IFA.

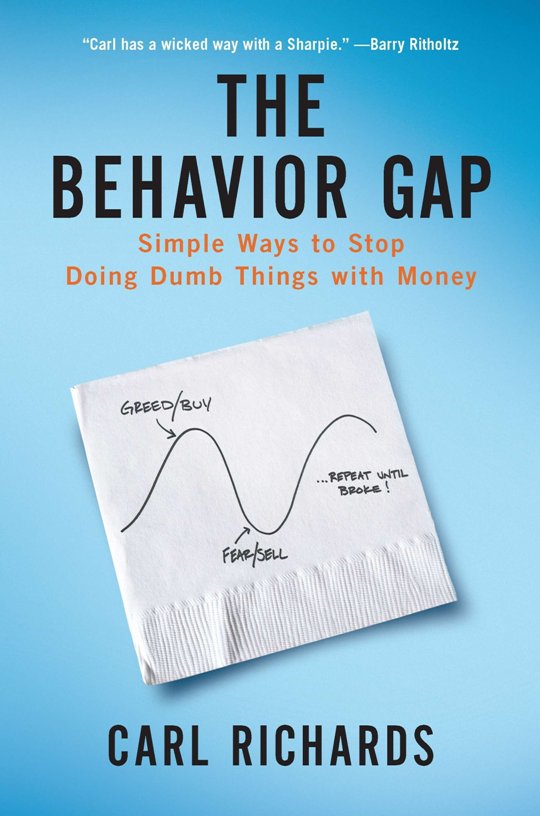

There is a gap between market returns and investor returns. Why is this? Carl Richards term it as 'behavior gap' by investors. It is one of the finest books written on investor psychology. Every IFA should read this book to gain insight into their own investors behaviour so that they can manage them well.

Anthony is among the most successful fund manager in the UK having delivered over 20% pa. returns in his Fidelity Special Situations Fund over a period of 25 years. In this book, he shares his style and strategy to become a great stock picker. Reading through the book gives an impression of how easy it is to make money in the stock markets. Still, most investors are not able to do that. The reason being lack of discipline and deviating from the core principles of investing. If you are connected to equity markets, you should read this one.

The book is about lessons from financial market cycles we repeatedly forget. It covers events spread over five centuries including; Tulipomania in the 17th century, the south sea bubble in the 18th century, the great depression in 1930’s, the great Indian securities scam in 1990’s, the dotcom crash and the sub prime crisis in the first decade of the 21st century and many others. Amit is an industry veteran and this book will act as a reminder to IFAs about the after effect of exuberance and make them a better investment manager.

Vinayak relates the timeless wisdom of Sant Kabir and Rahim with the investment world. Not only is this book a good read for investors but IFAs too. Most of the things we know but we forget them in our day to day lives and investing decisions. This book will help you refresh all of that.

Naval Ravikant is a successful individual and professional who lives a life of choice. The book offers many tips on living a good life, making good decisions, and becoming successful. I found it very practical and inspiring. The key message in the book is to 'earn with your mind, not with your time' and to be a voracious reader. The way he explains things with simplicity is commendable. A lot of wisdom in the book. You will definitely like this book. It is available free in PDF or you can prefer to buy it from stores. A must-read for everyone.

What a book! I bet if you start reading it, you will finish it at one go. A perfect recipe for success. Few books have ever been written in a gripping story format giving the essence of life and business. It's about a struggling salesman Joe who finds a super successful mentor, Mr. Pindar teaching him the five laws of stratospheric success. The key message in the book is - 'when you give, you get' and 'your income is determined by how many people you serve and how well you serve them'. A must read of everyone.

Peter Thiel was one of the co-founders of Paypal which was sold to eBay for 1.50 billion dollars in 2002. In this book, Peter shares his insights on startups and how to build the future. He discusses the founder's paradox, mistakes startups do, the 2nd mover advantage, the importance of marketing, the power of initial feedback, and many other useful insights. He argues that the next set of innovations would be completely different from the ones we see today. We need to ignore a preconceived notion and pattern of previous ideas and inventions. Not only this; he elaborates on what should you look in a startup before considering an investment into it and what should be the expected payoff for the risk taken. Brilliant examples and wisdom from someone who has done it all. I definitely got a few ideas from this book. I loved reading this one.

A masterpiece by Rolf Dobelli. In our every day lives we take so many decisions, small and big. A lot of such decisions are based on our cognitive biases. Though we think we are rational in our actions, the book will prove otherwise. It is much more common that we overestimate our knowledge than that we underestimate it. Is Harvard a good school? What is 'sunk cost fallacy'? Are you suffering from 'confirmation bias'? Are news anchors better than chauffeurs? What is action bias? Are you a victim of 'effort justification'? You are bound to find examples which will seem like yours. It's a small book with 99 nuggets. Don't hurry up to read this. Read slowly and sink in with every chapter. It will be worth it. A very interesting read for all.

Selling should not a win-lose game between sellers and buyers. It has to be a win-win. Burg and Mann demonstrate through their effective examples that selling need not be a stressful activity. It could, in fact, be a rich experience leading to a joyful life. To become an exceptional salesperson, one should focus on giving rather than wanting. The law of compensation says that your rewards will be directly proportionate to number lives you touch. One should be focused on the other person, ask good questions, be authentic and create exceptional value for the buyer. This book will definitely help you change your mindset from being a seller to a giver and thereby selling more.

Jim Collins does it again with another masterpiece. A result of extensive research on the world’s greatest companies, the book gives an insight on how some companies chose their way to greatness. In one of the chapters, Some of the key findings of the research were (1) Great companies took less risk than the comparison companies and yet produced vastly superior results. (2) Luck is not the reason for success. Comparison companies enjoyed better luck than great companies but they failed because they squandered it. (3) Great companies developed specific and concrete practices that could endure for decades. They changed them by an average of just 15% as compared to 60% by comparison companies. (4) Great companies were not visionary. They were empiricists. To quote one example from the book, Intel succeeded not because of innovation or creativity but discipline. (5) To achieve great results it is not necessary to make fast and radical changes simply because the world is changing fast. This is a must-read book. Brilliant examples and to the point. Other great works by Jim Collins are "Good to Great" and "Built to Last" which also I would recommend.

First published in the year 1936, it has sold over 30 million copies. This is one of the best books I have ever read. Through his golden words and tips, Dale Carnegie gives you the recipe of making great friends, become popular among people, increase your income, arouse others interest in you, become a better salesman and making your life happier. Read it today.

This book is considered to be the blueprint of personal development ever since its publication in 1988. The 7 principles mentioned in the book will not only improve the quality of your personal life but also assist greatly in your workplace, business and leadership. I read this book a decade ago and the learnings still seem fresh. I will highly recommend this book to everyone.

It's mostly is a time management book. IFAs need to become better time managers. The key idea in the book is to focus on a few big things every day rather than doing many small things. For IFAs, it means giving time to client meetings, reviews and self-learning. If you use your time well, you can grow more.

If you are looking for a book on strategy and marketing, this one is a must-read. The book is written after extensive research of hundreds of strategies used by several companies over the last 100 years. It concludes that rather than fighting in a competitive world (red ocean), one should aim to create an uncontested market place called the blue ocean. The message to IFAs in this book is that focus on your own niche and not be worried about competition.

Taleb describes a black swan as "a surprising or virtually unpredictable event that can have a massive impact. He challenges the notion of success and proves that most of it could be simply because of luck. Filled with numerous examples and research, this book will definitely hit your thinking pattern and the way you use probability in your life. It is one of the finest books you can read which cautions about the risk of historical evidence in life and business. You will need to focus while reading this book.

The 80/20 Principle is one of the best rules I have learned in my life. I have used it very effectively in my work and gained tremendously. The 80/20 Principle asserts that a minority of causes, inputs, or effort usually lead to a majority of the results, outputs, or rewards. For example, 80 percent of what you achieve in your job comes from 20 percent of the time spent. For IFAs, it means that their top 20% of clients give 80% of revenues and they should focus hard on them.